- Belgium comes to Yamashita Park

- Residential Villa in Phuket Entices Remote Workers With Long-Stay Rates

- Rare pieces of French glass art at the Mirai Museum of Art

- Feast on fresh fish and seafood at the 2024 ‘Sakana’ Festival

- Would you like to ride in a Louis Vuitton gondola lift?

- Naked Snow Aquarium

- Festive lights at Yomiuriland will get you feeling the holiday vibes

Japan’s stimulus package that could help those facing financial difficulties.

On April 30, the Diet has officially cleared a supplementary budget bill in response to the economic impacts of the novel coronavirus pandemic. Japan has allocated a budget of ¥12.8 trillion as assistance to people and businesses facing financial difficulties. Of this, ¥3.8 trillion has been earmarked to help small and medium size companies stay afloat, ¥2.3 trillion for small/medium-size companies and self-employed individuals having severe financial losses affecting jobs and their means of livelihood.

Japan’s stimulus measures have been published by the Ministry of Health, Labor and Welfare on May 1st, 2020 and summarized below according to purpose. The budget item in Japanese is indicated next to English for accuracy.

HIGHLIGHTS (Details are valid from May 1st but subject to update from time to time.)

❶ SPECIAL FIXED BENEFIT (tokubetsu teigaku kyufukin)

WHO CAN APPLY: A person registered in his ward as resident by April 27, 2020 wil receive ¥100,000. The deadline is 3 months from May 1st, or the date the government officially started accepting applications.

HOW TO APPLY

VIA ONLINE: For those who have been issued a My Number Card, you can now apply here. Follow the directions: https://myna.go.jp/SCK0101_01_001/SCK0101_01_001_InitDiscsys.form

For those who do not have a My Number Card and would like to be issued one, apply here with your information and a photo taken in the last 6 months (evenly centered with a white background and no shadows, eyeglasses, or masks): https://www.kojinbango-card.go.jp/en/

It takes about 2 weeks or earlier for your My Number card to arrive by post. If the photo you have submitted is not accepted, you will receive a notice by email to ask you to apply again with a new photo.

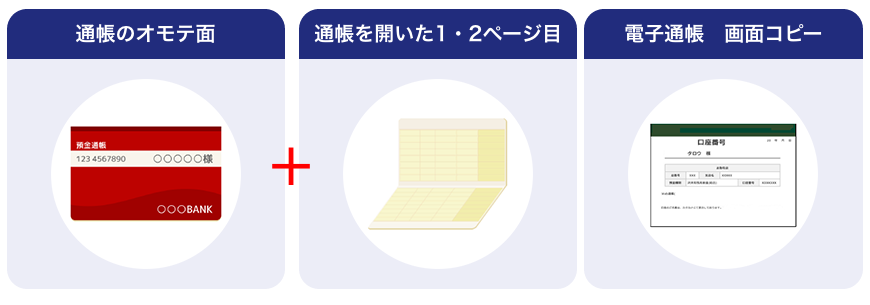

VIA POST : Just one form will be sent by the ward office to your registered address. It will be sent out to the head of your household. Fill out the names of all the members of the household (as beneficiaries), dates of birth, address, method of payment and bank account information (head of household’s), and send the application back with residence card photocopies of all the members of the household. The sum is then transferred to the applicant’s designated bank account.

WHEN WILL YOU GET THE MONEY? The start of accepting application and payment start date is decided by each municipality giving consideration to the urgency of the matter.

❷ TEMPORARY EXTRA BENEFIT FOR HOUSEHOLDS RAISING CHILDREN (kosodate seitai e no rinji tokubetsu kyufukin)

An extra benefit of ¥10,000 per child will be provided to child-rearing households affected by the new coronavirus infection. It is a one-off payment.

WHO CAN APPLY: Households with children born on or before March 31, 2019. This includes middle school students (or 1st year high school-aged children) by March 31, 2020.

The benefit will be provided by the municipality where you are registered as residents by March 31, 2019, the fiscal cut-off date. No application is required but a notification will be sent to your current registered address. If you have moved to a new municipality from April 1st, 2019, you need to contact them in order to receive your notification at your new address.

❸ SMALL EMERGENCY LOAN FOR LIVING COSTS Kinkyuu koguchi shikin sougou shien shikin (seikatsu-hi)

Funding comes from each prefecture’s Social Welfare Council in the form of small special loans. The amount a sole proprietor or anyone whose income was reduced or interrupted (due to suspension of school) can borrow is limited to 200,000 yen for households with 2 or more people and 150,000 yen for a single individual

. In other cases, the limit is set to 100,000 yen. Loan application has been open since March 2020.

WHO CAN APPLY: This emergency fund is for people facing temporary hardships in meeting their necessary living expenses as a result of suspension of work or unemployment caused by the new coronavirus infection. Even if you are employed but are experiencing a decline in income, you can avail of this emergency loan.

LOAN TERMS: The interest-free, unsecured loan (no collateral, no guarantor required) is payable within a year. The maximum grace period is 10 years.

Households whose income continue to decline will be exempted from paying resident tax. The maximum amount of 200,000 yen loan may be extended for 3 months in cases where income continues to decline for households with 2 or more members. (Maximum 800,000 yen).

❹ SUBSIDY PROGRAM FOR SUSTAINING BUSINESSES (for small and medium-sized companies and individual businesses) Jizoku-ka kyūfukin (chūken chūshō hōjin, kojin jigyō-sha-muke)

This subsidy program is intended for companies facing severe conditions in particular. The assistance is meant for a wide variety of purposes that, in general, are considered effective in sustaining or reviving their businesses. Application has started on May 1, 2020 and may be done online.

WHO CAN APPLY: Small and medium-sized companies and sole proprietors whose monthly sales have decreased by 50% or more compared to the same month of the previous year due to the impact of the new coronavirus infection. (Except large companies with capital of 1 billion yen or more.) It also covers a wide range of medical corporations, agricultural corporations, NPOs, and organizations other than companies.

AMOUNT OF SUBSIDY: The amount for small and medium size corporations is set at 2 million yen, 1 million yen for sole proprietors

WHEN CAN YOU GET THE SUBSIDY: In two (2) weeks

CONDITIONS: The method by which decrease is calculated as follows:

INCOME PREVIOUS YEAR – (Year on year ▲ 50% Monthly sales x 12 months)

(* Unit used 100,000 yen. Any amount less than 100,000 yen will be rounded down.)

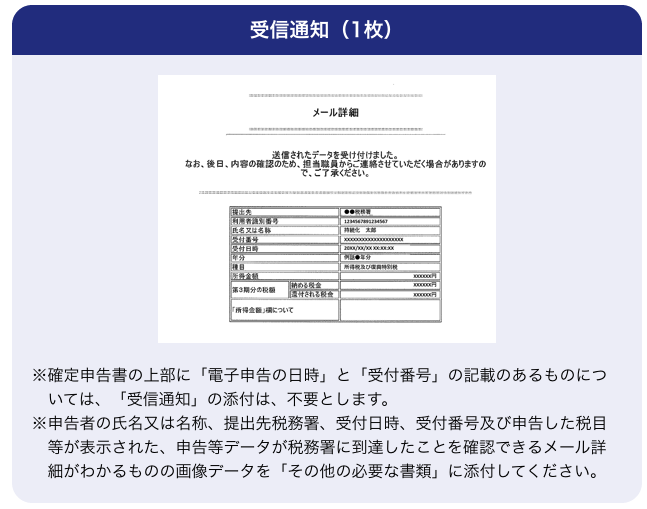

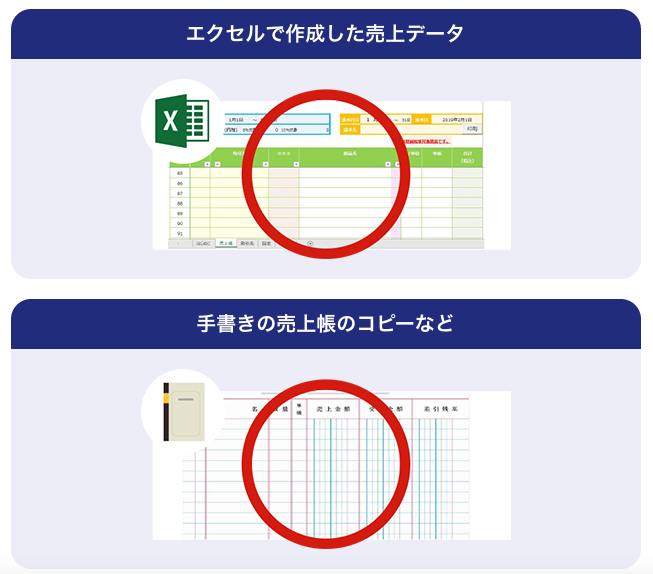

SUPPORTING DOCUMENTS REQUIRED:

❺ VIRTUAL LOAN ・ UNSECURED BUSINESS LOAN Jisshitsu murishi mu tanpo yūshi (jigyō shikin)

Unsecured and interest-free loans with a pre-determined credit line provided to support sole proprietors, including freelancers, self-employed whose source of income may have deteriorated due to the effects of the novel coronavirus infection. A flat interest rate will be determined for the first three years after the loan has been obtained regardless of creditworthiness or collateral.

WHO CAN APPLY 1.Those whose sales have decreased by 5% or more compared to the same period of the previous fiscal year or the year before last. 2. Freelance/Sole proprietors of a small scale business with business potential. a system was established for each credit line. We will set a flat interest rate that depends on creditworthiness and collateral, and reduce the interest rate by 0.9% for the first three years after getting the loan.

LOAN

Purpose of funding Operations or to fund equipment

Terms 20 years (if use is to fund equipment), 15 years (if use is for operations)

Grace Period within 5 years

Interest rate No interest on the first 3 years.Base rate ▲ 0.9% starts from the 4th year and beyond

Credit line Small and medium-sized business 300 million yen and 60 million yen for national corporations

Withdrawal limit 100 million yen for small businesses, 30 million yen for national corporations

WHEN TO APPLY Application acceptance which has not started yet will be announced once the payment requirements and application procedures have been finalized.

Saturday, Sunday and public holiday consultation Japan Government Finance Corporation: Tel 0120-112476 (National Life Business), Tel 0120-327790 (Small and Medium Enterprise Business) Okinawa Promotion and Development Finance Corporation: Tel 098-941-1795 Small and medium business finance and benefits consultation

0570-783183 (weekdays / holidays 9: 00 ~ 17: 00)

❻ GRACE PERIOD FOR SOCIAL INSURANCE AND WELFARE INSURANCE PREMIUM PAYMENT (ITEM 1) Shakai hokenryōtō no yūyo (1) for businesses

An emergency measure for people who are worried being unable to meet payment for social insurance premiums, national taxes, utility bills, etc.

Grace Period System for payment of employee pension insurance premiums can be applied in the following cases:

1. There is a potential risk to the business in paying welfare pension insurance premiums etc. at one time. In some cases, if you meet certain requirements, you may be allowed to postpone the conversion price by making an application at the relevant pension office within 6 months from the premium payment’s due date.

2. In some cases where temporary payment of welfare pension insurance premiums, etc. has become difficult, you may be allowed to delay the payment by making an application. The application should be made through your local welfare (branch) director at the pension office that has jurisdiction in your ward citing any of the cases below:

a. Direct impact from a disaster or theft of property

b. Direct impact due to an illness or injury by a business owner or a breadwinner in the family responsible for your livelihood

c. Direct impact from discontinued or suspension of business

d. Sustained significant loss of business

WHO CAN APPLY: Business owners for whom the impact of the coronavirus has resulted in a 20% decrease in revenues compared to the same period of the previous year (1 month or more) after February 2019. Payment of welfare pension insurance premiums is postponed to a year with no collateral or delinquency fees required.

* Applicable term: Welfare pension insurance premiums, etc. that are due from February 1, 2019 to January 31, 2019.

❼ GRACE PERIOD FOR SOCIAL INSURANCE AND WELFARE INSURANCE PREMIUM PAYMENT (ITEM 2) Shakai hokenryōtō no yūyo (2) for individuals

Exemption or postponement of all or in part of premium payments for National health insurance, national pension, medical care system for the elderly and nursing care insurance (tax) reduction, etc. is allowed. Application required for this purpose is now underway since May 1, 2020.

WHO CAN APPLY Those whose income after February 2019 has been reduced by a considerable amount due to the influence of the new coronavirus infection.

● Contact information

・ Use the Japan Pension Service “Nenkin Subscriber Dial” TEL: 0570-003-004 * Tel 03-6630-2525 when calling from 050 number

・ Apply at the national pension department or pension office in your municipality.

❽ GRACE PERIOD FOR NATIONAL TAXES (ITEM 3 ) Kokuzei no nōfu no yūyo seido

If it is difficult to pay the national tax at one time due to the effects of the new coronavirus infection, you may be allowed to postpone the exchange price by applying to the tax office. Consult the tax office first who will examine your situation. In addition, tax payment may be granted under the following circumstances.

1 When a considerable loss of property has occurred due to a disaster

2 When a person or his family suffers from an illness

3 When a business is abolished or suspended

4 When the business has incurred significant losses

◆ The term for those allowed to postpone is one year. (Depending on the situation, there may be an additional one year grace period.) ◆ Late taxes during the grace period will be reduced or exempted. ◆ Foreclosure or conversion (selling) of property will be suspended.

National Tax Agency https://www.nta.go.jp/taxes/nozei/nofu_konnan.htm For specific inquiries or inquiries regarding collection delays, please contact the prefecture or municipality where you live.

❾ GRACE PERIOD FOR UTILITIES PAYMENT (Item 4)

For those (individuals or companies) who have difficulty in paying electricity, gas, water, landline/mobile phone, NHK viewing charges due to the coronavirus outbreak, suppliers have been requested by the business operators to give due consideration and to respond promptly and flexibly, such as delaying payment.

Electric companies supporting the grace period

https://www.enecho.meti.go.jp/coronavirus/pdf/list_electric.pdf

Gas companies supporting the grace period

https://www.enecho.meti.go.jp/coronavirus/pdf/list_gas.pdf

❿ RENT SUBSIDY Jūkyo kakuho kyūfukin (yachin)

The subsidy is for people who face the risk of losing a roof over their head as a result of decreased income due to leave, separation, etc. The government will expand subsidy to cover the rent for a certain period.

WHO MAY APPLY 1. Foreigners with ‘permanent resident’ status only. * 2. Persons who have lost their income within the last 2 years after losing job as a result of employer’s business closure or leave, etc. (Update: As of end of April, all foreigners with work visa status are eligible to apply for the subsidy and loan).

SUBSIDY The term is for 3 months in principle. If you are looking for a job in good faith it can be extended up to 9 months. The standard subsidy amount for special wards of Tokyo: Single household: 53,700 yen, 2-person household: 64,000 yen, 3-person household: 69,800 yen

REQUIREMENTS TO QUALIFY ○ The amount must not exceed the housing special assistance limit. The limit is calculated as : 1/12 of tax exempted household income + rent amount (upper limit of housing assistance special standard amount)

(Tokyo special ward standard) Single household: 138,000 yen, 2-person household: 194,000 yen, 3-person household: 241,000 yen ○ Household assets in terms of deposits and savings should not exceed Tokyo special ward standard: 504,000 yen for Single households, 780,000 yen for 2-person household: 1 million yen for 3-person household ○ Must be honest and enthusiastic about job hunting * Application for Hello Work is not required at the time of application (after April 30, 2020)

National contact list https://www.mhlw.go.jp/content/000614516.pdf